39+ california mortgage interest deduction

According to the Tax Cuts and Jobs Act of 2017 taxpayers may deduct up to. Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt.

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Do you have a second 1098 to report that is equity debt in addition to the 1098 for your original loan.

. Web According to this State of California website this deduction will allow deductions for home mortgage interest on mortgages up to 1 million plus up to 100000 in equity debt. Web Schedule A is a place to tally various itemized deductions you want to claim. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web California does not allow a deduction for mortgage insurance premiums. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

See what makes us different. Say Thanks by clicking the thumb icon in a post. Find A Lender That Offers Great Service.

Web California Rules For Mortgage Interest Deduction In the state of California they use the same value that is on an individuals federal tax return. Web California mortgage interest adjustment. Web Unfortunately furniture and home decor are not eligible for this mortgage interest credit in California3.

However higher limitations 1 million 500000 if married filing separately apply if you are deducting mortgage interest from indebtedness incurred before December 16 2017. Stuff youll need if you want to. Web Under his bill AB1905 about 175000 taxpayers would lose their mortgage interest deduction for second homes and owe approximately 1000 more on their.

Also you can deduct the points. Web Also the TCJA lowered the cap on mortgage interest deductions from 1 million to 750000 for married couples filing jointly and from 500000 to 375000 for. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. We dont make judgments or prescribe specific policies. Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders.

Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly. Web The bill would have also lowered the deduction cap from 1 million to 750000 similar to the federal mortgage interest deduction cap established by the. For tax year 2022 those amounts are rising to.

Compare More Than Just Rates. You then enter the total deductions on your Form 1040. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Gifts by Cash or Check Qualified Charitable Contributions Your California deduction may be different. Homeowners who bought houses before. The instructions say Enter the amounts you did not deduct on the federal return that were limited My HELOC is.

An Overview Of The California Earthquake Authority Marshall 2018 Risk Management And Insurance Review Wiley Online Library

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Itemized Deductions For California Taxes What You Need To Know

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

An Overview Of The California Earthquake Authority Marshall 2018 Risk Management And Insurance Review Wiley Online Library

Mortgage Interest Deduction How It Calculate Tax Savings

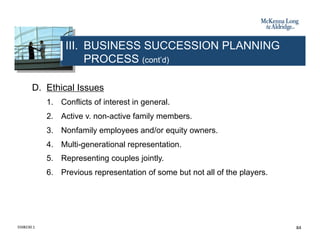

Business Succession Planning And Exit Strategies For The Closely Held

Californians Home Mortgage Deduction Would Be Capped Under New Bill

Mortgage Interest Deduction A 2022 Guide Credible

The Mortgage Interest Deduction Tax Subsidy For The Rich Must Go The Sacramento Observer

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Is My Mortgage Interest Still Tax Deductible The Henry Levy Group A Cpa Firm

Vacation Home Rentals And The Tcja Journal Of Accountancy

![]()

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Itemized Deductions For California Taxes What You Need To Know

Crc Def14a 20190508 Htm

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep